Why Cannabis Stocks Dipped After Trump’s Executive Order?

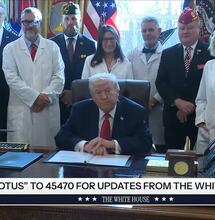

President Donald Trump officially signed the executive order titled “Increasing Medical Marijuana and Cannabidiol Research” on December 18, 2025, a move widely considered the most significant federal policy shift in over half a century. While the order paves the way for the rescheduling of cannabis to Schedule III, the stock market responded with a classic “buy the rumor, sell the news” reaction that left many retail investors in the red.

The Green Wave Surged Before Hitting a Wall

Leading up to the December 18 announcement, anticipation reached a fever pitch. Cannabis stocks climbed as investors positioned themselves for the formal end of federal prohibition-style restrictions. According to reports, the stock of major player Tilray Brands was up 28% at its high in the days prior to the signing of the executive order. The AdvisorShares Pure US Cannabis ETF (MSOS) reached its highest trading volume of the year. And so on. But Trump’s green wave has once again hit a wall.

The Post-Signing Sell-Off: Why Did It Happen?

Despite the historic nature of the executive order, markets turned volatile minutes after the ink was dry. By the closing bell, cannabis stocks had given back earlier gains. U.S.-listed shares of Tilray slid 4.2%, Aurora Cannabis dropped 3.4%, SNDL lost nearly 1.5%, and Canopy Growth closed down almost 12%. The pullback followed a strong afternoon rally, when those same names were trading up between 6% and 12% before momentum reversed, according to Reuters.

Analysts point to two primary factors for this “green wall” collision. First, the order did not include immediate provisions for SAFE Banking, leaving the industry’s capital access issues to Congress. Second, high-frequency traders took immediate profits, triggering a cascade of sell orders.

“Each time that there has been a step forward in the direction of legalization — allowing growers to go public, legalization in some states — there has been a brief boom in cannabis stocks followed by a slide,” said Art Hogan, chief market strategist at B. Riley Wealth, Reuters reported.

The Real Winner: IRS Section 280E Relief

While the ticker symbols showed red, the long-term fundamentals for state-licensed dispensaries have never been stronger. By directing the Attorney General to move marijuana to Schedule III, the order effectively triggers the future removal of IRS Section 280E.

Currently, this tax code prevents cannabis businesses from deducting standard operating expenses, leading to effective tax rates as high as 80%. The removal of 280E is expected to inject between $1.6 billion and $2.2 billion in annual cash flow back into the industry starting in 2026. This fundamental shift makes the Rec Market significantly more attractive for institutional investment.

The Medicare CBD Wildcard

A notable (and still evolving) element of the executive order is its directive for the Centers for Medicare & Medicaid Services (CMS) to explore a pilot framework for hemp-derived CBD. While implementation details have yet to be finalized, the initiative signals potential future pathways for seniors and veterans to access verified therapeutic CBD products through federally supported programs; eligible parties might receive up to $500 annually as part of the deal.

If it happens, this would mark a major step toward federal recognition of the 2018 Farm Bill–compliant hemp sector and could ultimately unlock a significant new consumer base, pending CMS rulemaking and guidance.

A New Era for the US Market

The December 18 executive order is expected to fundamentally change the landscape of the USA cannabis industry. The structural changes to federal law and tax liability represent a “total rewrite” of the industry’s profitability potential. Still, at the moment, market volatility remains there; investing in cannabis stocks continues to involve significant risk due to the evolving legal framework.

Read more from Soft Secrets:

_11zon.jpg)